During a recession, many employers are tempted to cut costs, including those for group benefits. This can be a mistake, because group benefits are what can separate you from your competition during a difficult labour market helping you retain your current employees and recruit new ones. You need to stay in line with industry standards, while maintaining a positive corporate culture. And remember, next year there may be higher disability and drug costs and an increased need for health and wellness programs as people return to the workplace. That means the pressure will be on private group benefits plans to pick up the slack for many of these post-pandemic costs.

During a recession, many employers are tempted to cut costs, including those for group benefits. This can be a mistake, because group benefits are what can separate you from your competition during a difficult labour market helping you retain your current employees and recruit new ones. You need to stay in line with industry standards, while maintaining a positive corporate culture. And remember, next year there may be higher disability and drug costs and an increased need for health and wellness programs as people return to the workplace. That means the pressure will be on private group benefits plans to pick up the slack for many of these post-pandemic costs.

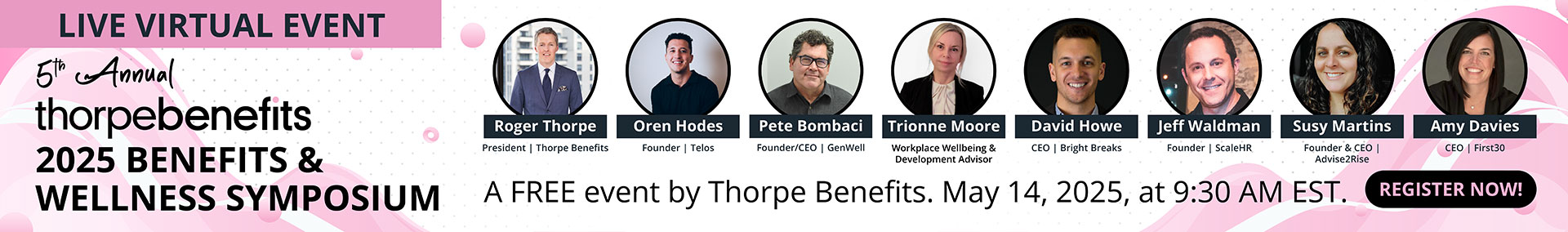

Start doing a group benefits budget forecast early to ensure you are ready for what lies ahead. Examine your past costs per employee as well as your priorities to determine what return you expect from your group benefits’ investment. We, at Thorpe Benefits can help you project your costs for the next year and model different scenarios that will give you options that are ready to execute. You may end up rethinking what you want to do with plan design and employee cost share. For instance, you may choose to reallocate money towards a current crisis such as employee mental health while reducing your investment in longer-term aspects of your plan.